Time to invest

You just got used to 10%. Now super’s increasing to 10.5%

June 15th, 2022

On 1 July 2022, the amount of superannuation guarantee (SG) employers should start paying employees will rise from 10% to 10.5%.

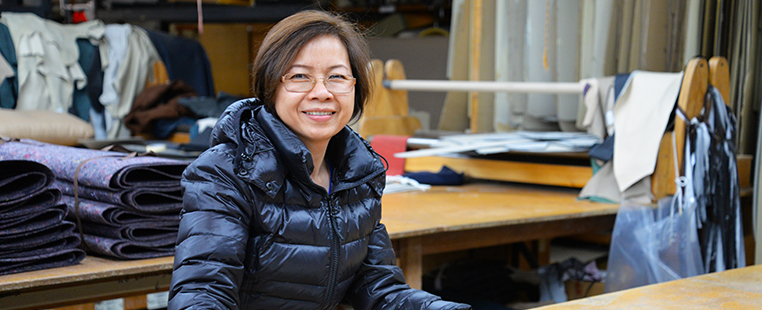

How we invest for you

November 18th, 2021

At First Super, we aim to get you the best results over the long term. So when you’re ready to retire, your super’s ready too. For our pension members, we know consistency is important, so you can plan your spending for your retirement lifestyle. Our focus is on striking the right balance between growing your […]

Are you a COVID cash switcher?

July 7th, 2021

Investing can be emotional. That’s never been truer than the early months of the COVD-19 pandemic last year, when share markets resembled a rollercoaster with more drops than climbs. Nobody likes watching their balance fall, particularly if you’re close to retirement and your super isn’t just future savings – it’s your income. It makes it […]

You could save 10% more into super

July 7th, 2021

On 1 July 2021, the amount you can contribute to super each financial year increased by 10%. That’s because the Government lifted the contribution cap limits on concessional (before-tax) and non-concessional (after-tax) contributions. Here are the new caps, effective 1 July this year. Contribution caps 2020/21 (previous FY) 2021/22 (current FY) Concessional (before-tax) contribution cap […]

Higher limits for first home savers

July 7th, 2021

Saving for a first home deposit is challenging. Now that we’ve stated the obvious, what can you do about it? You might be surprised to learn that over the last few years the Government has made some changes to super so first-time buyers can save faster for a home using their super account. While this sounds great […]

Budget changes to super: more super for a first home and the end of the “work test” for older Australians

May 12th, 2021

The 2021-22 Federal Budget has been handed down, with several changes to super and retirement being announced. Most were adjustments to existing rules, rather than sweeping changes. We’ve summarised the key points for members below. FIRST HOME BUYERS CAN SAVE EVEN MORE OF THEIR DEPOSIT IN SUPER UNDER THE FIRST HOME SUPER SAVER SCHEME. The current situation: Eligible first home […]