News & Media

Media Statements & Releases

Latest News

Monthly investment update – May 2022

July 1st, 2022

Here’s a look at what’s been happening in investment markets recently and what it means for your superannuation. The big picture Since late January 2022, share markets have experienced considerable volatility. These sharp, sudden drops were reactions to increasing inflation in the US and other economies. If we look back to April 2021, inflation already […]

First Super a top 10 super fund

April 4th, 2022

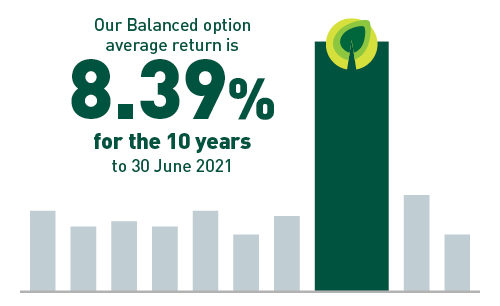

That’s according to superannuation regulator APRA’s (Australian Prudential Regulation Authority) annual performance test, which measures super fund performance and holds underperforming funds to account. First Super passed the 2021 test with flying colours. In fact, our default MySuper product (the Balanced option) scored in the top 10 of the 80 funds that were tested. Isn’t […]

The Federal Budget 2022

March 31st, 2022

What does it mean for your super and pension? There were no big surprises for the super industry in this year’s federal budget. Super and pension members can expect to see the following changes (which were originally proposed in 2021) start coming into effect from 1 July 2022. Superannuation and retirement First Home Super Saver […]

Investment update: Russia and Ukraine crisis

March 15th, 2022

The ongoing events in Ukraine are deeply concerning, and we are hoping for a peaceful and swift resolution to the war. In the meantime, as investors responsible for your retirement savings, we are closely monitoring the situation and its impact on share markets. As you may be aware, this year has already been volatile for […]