First Super a top 10 super fund

April 4th, 2022

That’s according to superannuation regulator APRA’s (Australian Prudential Regulation Authority) annual performance test, which measures super fund performance and holds underperforming funds to account.

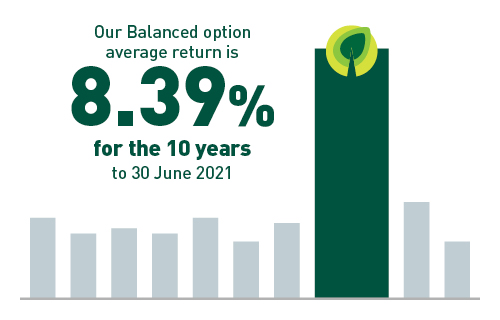

First Super passed the 2021 test with flying colours. In fact, our default MySuper product (the Balanced option) scored in the top 10 of the 80 funds that were tested.

Isn’t it good to know you’re with a top performer?

First Super ranked #8 in the top #10 high-performing funds in APRA’s performance test.

What’s the performance test all about?

Each year, APRA will set a benchmark result, which super funds must meet to pass the test. If they fail two years in a row, they will no longer be able to accept new members. In 2021, 13 funds failed the test.

Small enough to support our members, big enough to deliver results

First Super manages around $3.5 billion in retirement savings. We tested better under the APRA test than funds with more than $30 billion in retirement savings. Being a high-performing small fund means we deliver strong investment returns for members – and we still pick up the phone when you call.

Disclaimer: This content was prepared by First Super Pty Ltd (ABN 42 053 498 472, AFSL 223988) as Trustee of the First Super superannuation fund (ABN 56 286 625 181). The contents were accurate at April 2022. You can obtain a PDS by calling 1300 360 988 and should consider it before making any decision. This document cannot be relied on as personal financial advice. You can obtain personal financial advice from us by contacting us on 1300 360 988. Financial advice will be provided by Industry Fund Services Pty Ltd (ABN 54 007 016 195, AFSL 232514) and may be free of charge to you. Past investment returns are not a reliable indicator of future returns.