Susan and David’s story

Retired with $800,000 in super

David and Susan have been married for more than thirty years. They both retired five years ago after David turned 60. Susan was 61. They both held professional careers but looked forward to retirement.

Financially, Susan and David have always been quite comfortable. They don’t have children and own an investment property which is rented out full time.

Both have earned super for a large part of their working lives so when it came time to prepare for retirement, they spoke with First Super’s financial planners about how to maximise their income in retirement.

With an investment property worth around $500,000 and super balances of $350,000 and $450,000, they wouldn’t have access to the Government Age Pension.

However, a combination of the rental returns and regular income from their super funds via a Retirement Income account would be a sensible option. That way, they would receive regular payments and the balances of their First Super accounts would continue to grow during the early years of retirement before they gradually draw down on all of it.

Susan and David wanted flexibility and control of their money so they could take extra out from time to time if they needed, which their First Super Retirement Income account was able to provide for them.

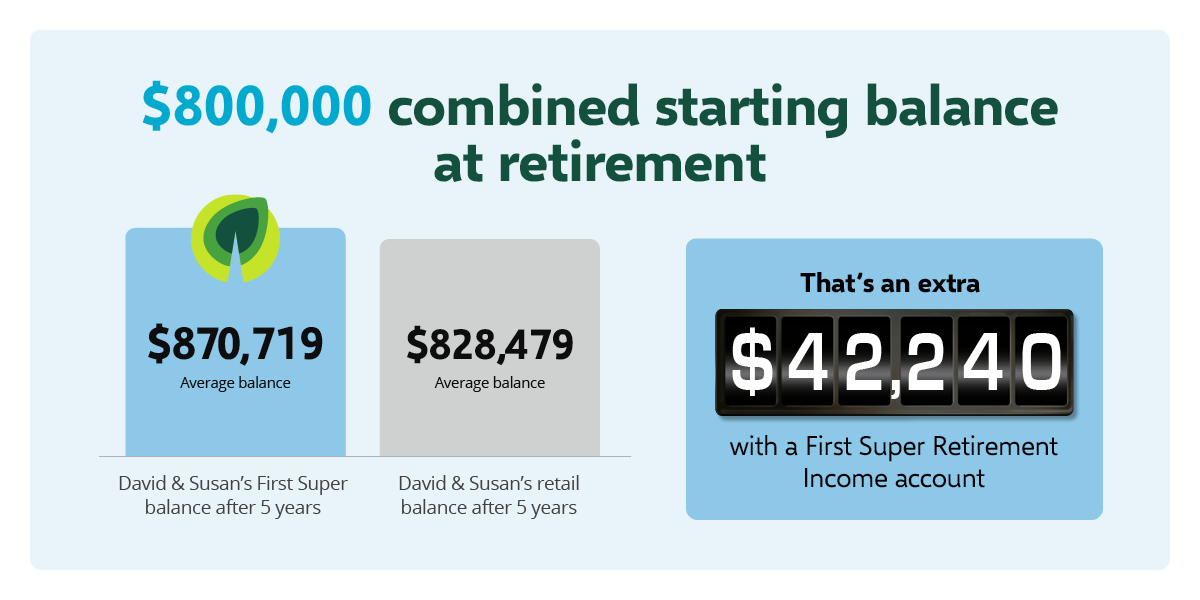

Taking their financial planner’s advice and sticking with First Super would also mean their balances grew by more than if they had switched to a retail fund.

Here’s what that looked like:

- When they retired, Susan’s super balance was $350,000 and David’s super balance was $450,000. They converted their super accounts into First Super Retirement Income accounts.

- When they retired, their investment property was worth around $500,000 with an annual income of on average around $26,282.

- Over the past five years they withdrew a combined amount of on average around $40,182 each year from their First Super Retirement Income accounts.

- Susan and David experienced an annualised five year First Super investment return of 6.95% (2019-2024)1.

- Over the past 5 years their balances have grown to $380,940 and $489,779 respectively.

- If they had switched to a retail super fund at retirement, their balances would only be $362,393 and $466,086 respectively.

That’s a difference of $42,240 after five years, simply because they stuck with First Super.

| David | Susan | David | Susan | |||

| Account balance after income taken | Account balance after income taken | Retirement Income payments | Retirement Income payments | Investment property income | Total income | |

| 2019/20 | $450,000 | $350,000 | $22,500 | $17,500 | $25,000 | $65,000 |

| 2020/21 | $422,268 | $328,430 | $21,113 | $16,422 | $26,625 | $63,160 |

| 2021/22 | $468,077 | $364,060 | $23,404 | $18,203 | $26,266 | $67,872 |

| 2022/23 | $449,841 | $349,876 | $22,492 | $17,494 | $26,922 | $66,908 |

| 2023/24 | $470,779 | $365,584 | $23,502 | $18,279 | $27,595 | $69,376 |

| Closing balance | $489,779 | $380,940 |

We’re here to help. So, let’s talk

If you have any questions, call our Member Services team on 1300 360 988, email us or use the Live Chat. The 5% drawdown may not be right for you, so book an appointment with one of our financial planners to discuss your situation or click the link below to find out more about our Retirement Income account.

Susan and David are not actual members. Their stories have been created for illustrative purposes.

1Past performance is not a reliable indicator of future performance and should never be the sole factor considered when selecting a fund. Investment return figure follows SuperRatings’ Net Benefit Modelling (including the returns after fees are taken out) applied to all Industry SuperFunds’ performance figures, which is different from First Super’s 7.01% calculated return for the same period.

Comparisons modelled by SuperRatings, commissioned by ISA and show average difference of the ‘main pension Balanced option’ of First Super and retail funds tracked by SuperRatings, over a 5 year period. A ‘main pension Balanced option’ being the fund’s largest pension Balanced option where 60% to 76% of the fund’s assets are invested in growth investments. Where a fund does not have a Balanced option, the option closest to SuperRatings’ benchmark range of 60% to 76% growth investments is used. Outcomes vary between individual funds. Modelling performed on 16 October 2024 using data as at 30 June 2024. See firstsuper.com.au/retirement-assumptions for more details about modelling calculations and assumptions.

First Super financial planners are authorised representatives of Industry Fund Services Limited (ABN 54 007 016195, AFSL 232514).

Issued by First Super Pty Ltd (ABN 42 053 498 472, AFSL 223988), as Trustee of First Super (ABN 56 286 625 181). This article contains general advice which has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the advice is appropriate for you. Read the Product Disclosure Statement (PDS) before making any investment decisions. To obtain a copy of the PDS or Target Market Determination please contact First Super on 1300 360 988 or visit our PDS & Publications page.