Grow your super with a government top-up

September 25th, 2020

If you earn below $54,837 a year, you could be eligible for a super co-contribution of up to $500. It’s a great way to grow your super without having to do it all yourself. Here’s how it works.

The Government Co-contribution

Put a little extra money into your super before the end of the financial year and, if you’re eligible, the Government will chip in up to 50c for every dollar you pay, up to $500.

Exactly how much you receive depends on what you earn and how much you contribute. Broadly speaking, you’ll receive more if your income is below $39,873, and less the closer your income is to the $54,873 cut-off.

- To work out the exact amount you could receive, try using the Super contributions optimiser.

What do you need to do?

To receive the co-contribution, simply:

- check you meet the eligibility criteria below

- call us on 1300 360 988 or email us for your customer reference number

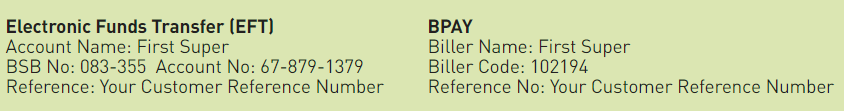

- make a voluntary contribution to your First Super account using these details

Once you lodge your tax return for the year, the ATO will pay any co-contributions into your super account automatically.

Are you eligible for the co-contribution?

To be eligible, you must:

- make a voluntary contribution to super (that isn’t claimed as a tax deduction)

- have a total income of less than $54,837 for the 2020/21 financial year

- lodge a tax return for that year of income

- be a permanent Australian resident under 71 years of age

- have provided First Super with your tax file number

- have at least 10% of your ‘total income’ come from employment-related activities and/or running a business, and

- be under the super contribution caps and total super balance.

You can find more details on our dedicated Government Co-contribution webpage. You can also use the link on that page to tell us that you’ve made a payment.

For more information about eligibility, visit the ATO’s webpage on Super Co-contributions.

We’re here to help. So let’s talk.

If you have questions about this or any other super matter, please call our Member Services Team on 1300 360 149 or email us.